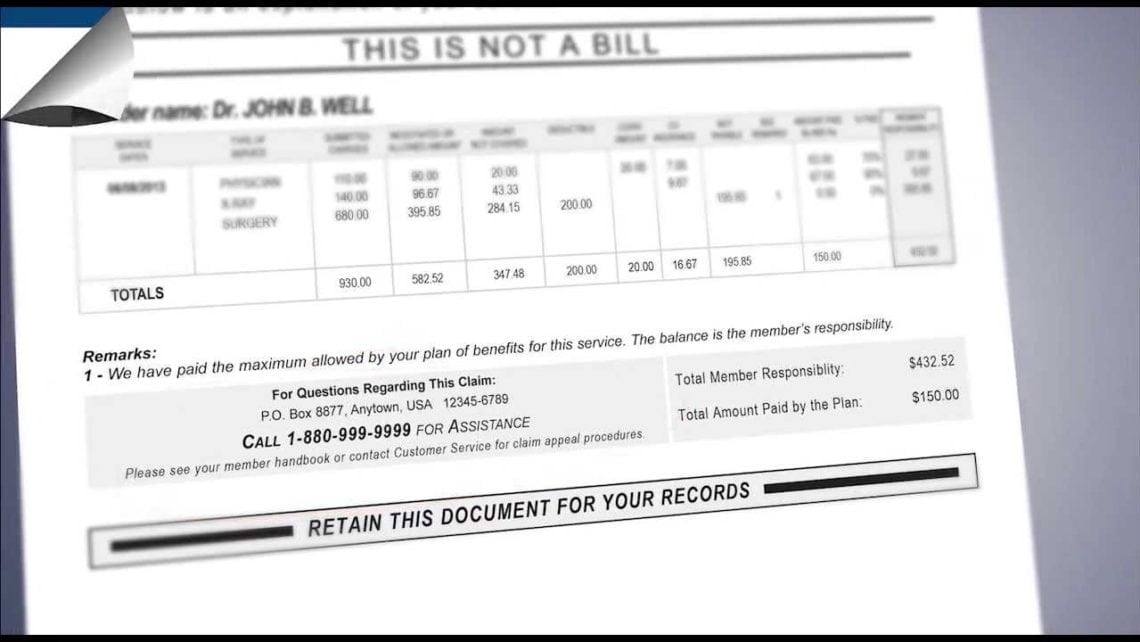

An Explanation of Benefits, or EOB, is a form filled out by a health insurer and sent to a policy holder to indicate the health care services for which the company paid.

These can take several months after obtaining medical care to arrive in your mailbox. If you are have an employer-based health plan, individual health insurance or Medicare, an EOB will most likely be part of the process of using medical services.

Included Information

EOBs outline the type of care that you received, including the date the services was performed, a description of the service and claim number representing the type of service, the providers name and address, and the name of the patient.

These documents also list the amount charged, or billed charge, by the doctor or hospital for the service, and the amount allowed by the insurer. The allowed amount, or not covered amount, is the amount of money that was not paid by the health insurance company to the provider.

There may also be a corresponding code on the EOB explaining why the doctor or hospital was not paid a certain amount. Such codes can often be found at the bottom of the form, on the reverse side, or in an attached note, though they are not required information.

Very importantly, the total patient cost is also listed, which is the remaining balance owed by the patient. This amount is based upon the out-of-pocket payment criteria of your personal health insurance policy. All out-of-pocket expense types are taken into account, such as your deductible, coinsurance and copayments. If you received a type of medical care that your plan does not cover, you are expected to meet the amount in full.

If any claims were denied, the Explanation of Benefits statement will show this and describe what happened. Additionally, the EOB will offer information on how to begin the process of making an appeal.

Other optional information that may or may not be included on an EOB are the amount applied to the patient’s deductible, annual out-of-pocket total, and/or lifetime maximums. EOBs can also indicate whether the provider is operating under an HMO or PPO. Another code could possibly also appear to represent the National Provider Identifier belonging to the rendering provider.

EOB Errors

The healthcare system is operated by human beings, and at times people and/or computer glitches can cause billing or coding errors.

Between all of the hands through which a claim is processed, there is always the possibility for a mistake to be made by one of the parties involved. As one would imagine, these mistakes can result very badly, and begin a series of considerable long-term financial repercussions. As you receive a copy of your EOB, always keep it as a record in case an error ever does take place.

Make sure to read over your EOB with care, as to discover any numbers that do not make sense or are not properly explained or calculated.

Other mistakes to look for are the correct coding that corresponds with your treatment and diagnosis. Possible errors include double billing, where both the primary care doctor and specialist send the claim to an insurer and a patient is charged twice. Coinsurance amounts can also be miscalculated, and the wrong number for a diagnosis or procedure may be included.

In a worst-case scenario, you could also experience medical identity theft or insurance fraud. This can occur when individuals get their Medicare or other plan identification numbers stolen.

Your EOB should also include a phone number for customer service if you have any remarks or concerns regarding the information listed on the form.

Leave a Comment